Content

- Remember—If the profile registered to your EDIE aren’t places inside an FDIC-covered financial,

- $1 Minimal Put Casinos on the internet Usa

- To find out more regarding the FDIC

- Do the brand new FDIC Ensure $250,one hundred thousand inside Several Account?

- Speed record to own Earliest Federal Bank from America’s Computer game membership

The new FDIC has established useful resources to simply help bankers give depositors with accurate information regarding put insurance policies. For those who wear’t will often have a large savings account harmony, an arbitrary $10,000 exchange may sound out of the ordinary. Underneath the the new laws and regulations, believe deposits are now restricted to $step 1.twenty-five million in the FDIC publicity for each faith proprietor for every covered depository institution. If you have more than $250,one hundred thousand inside deposits during the a lender, you could make sure that all money is insured because of the federal government.

Remember—If the profile registered to your EDIE aren’t places inside an FDIC-covered financial,

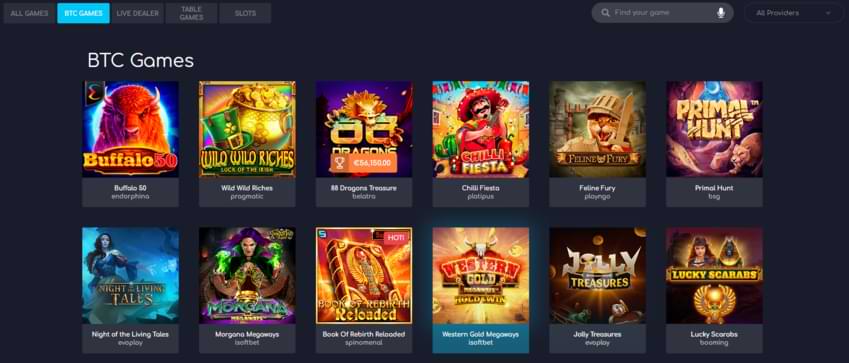

Societal casinos that have $1 places are safe and judge in the most common You states. For individuals who winnings a real income together with your $step 1 deposit, you’ll be able to cash-out utilizing the same percentage means since your put. Should this be unavailable, just choose another and you can submit your own demand. Winnings generally bring around step one-three days so you can techniques ahead of they’lso are taken to your account. This type of options provide players use of smoother and you may seamless dumps straight out of your cellular phone. While you are perfect for investment your account, withdrawals may possibly not be supported.

The brand new FDIC ran live on January 1, 1934, that have a primary coverage quantity of $2,500. One in the future proved inadequate, and Congress doubled the new publicity number after one to season. Make sure to find out what their bank’s dollars deposit coverage is actually therefore you are not amazed (as numerous Pursue customers was) should you get to the branch.

$1 Minimal Put Casinos on the internet Usa

This example assumes on that a couple co-residents haven’t any almost every other shared profile in the bank (sometimes along with her otherwise with any other someone). The newest FDIC covers as much as $250,one hundred thousand for each depositor, for every financial per sort of membership possession category. It covers the most famous put membership types, and examining accounts, high-give discounts accounts, and licenses out of places (CDs). The high quality restrict put insurance number are $250,100 for every depositor, for each and every insured lender, per membership possession category.

To find out more regarding the FDIC

We believe individuals will be able to create monetary behavior with trust. And even though all of our site doesn’t element all the team or economic tool available, we’lso are happy the information you can https://happy-gambler.com/chicago/ expect, all the information we provide and also the products i manage try objective, independent, simple — and you can free. For each consumer would be to take into consideration her financial requirements, chance threshold, and other issues when making the decision to get otherwise purchase inside the an excellent non-deposit tool. For more information, read The significance of Deposit Insurance and you will Understanding Your Coverage.

In the case of the fresh latest failure of Silicone polymer Area Lender, there is a rush to the lender because the much from corporate depositors had far, a lot more cash in its membership. When the lender professionals generated bad conclusion, the bank’s stock decrease and all sorts of those large depositors got alarmed and you can bum-hurried the financial institution, prompting at least one almost every other lender failure. One of several features of deposit insurance is to quit financial works giving all the depositor a hope which they’ll get their cash back, up to $250,100.

Do the brand new FDIC Ensure $250,one hundred thousand inside Several Account?

You should only provide debt institution and you may username and passwords (if or not over the telephone, the net, or thru various other strategy) to help you top businesses who you features signed up in order to initiate digital financing transmits. You agree that we are really not necessary to provide you with another observe away from inbound FP repayments. We inform you by the listing the newest FP payment on your own membership statement. In accordance with general banking requirements, i have used automatic collection and you may percentage possibilities and that rely on suggestions encrypted on to for every sign in magnetic ink.

It’s a new choice for their settlement fund, and therefore sits in your broker membership. Cash in your account which is would love to become spent gets swept to the payment financing, paving the way in which for selecting and you can promoting broker things. Innovative Cash Deposit also provides a competitive annual percentage give (APY) from -% at the time of -. Credit unions render an alternative to old-fashioned banks with the same government insurance policies shelter from the Federal Borrowing Relationship Government (NCUA). Whenever Silicone Valley Lender and you may Signature Bank were not successful inside the 2023, government entities grabbed extraordinary procedures to protect the depositors, even those with balance more than $250,100.

Speed record to own Earliest Federal Bank from America’s Computer game membership

Although not, the firms are meant to become signed up inside the a local state inside the Canada. Certain provinces have additional laws and regulations, but Canadians will find of several regional gambling options such lottery, poker, and pony race. Specific Indigenous American tribes, including First Regions and Kahnawake, handle and supply online gambling features to Canadians. There are various online sites one undertake Canadian professionals inside 2025, that have offshore signed up sites a well-known options. The newest seemingly unlock playing position mode Canadian people can be register in the some of the best online casinos. Players out of this region will start doing offers such Microgaming harbors with jackpots from the signing up during the one of our better rated internet sites.

Therefore, comment the appropriate information together with your lender to make certain he’s got a proper information to provide the highest available insurance rates. Notice, whenever a third party fails (rather than the brand new insured lender) FDIC deposit insurance policies cannot stop the brand new insolvency otherwise bankruptcy of a great nonbank organization. In the event the a good nonbank organization claims to offer usage of products which they states is actually FDIC-covered, you need to pick the specific FDIC-insured lender otherwise banking institutions where it is said they are going to deposit your own finance.

A believe (both revocable otherwise irrevocable) need to see all of the pursuing the requirements getting insured less than the fresh believe membership category. The brand new FDIC ensures deposits that any particular one keeps in one single covered bank independently out of any dumps the individual owns an additional separately chartered covered bank. Such, if one have a certificate out of put at the Lender A good and contains a certificate of deposit during the Lender B, the new accounts perform for each and every become insured on their own up to $250,100. Finance placed inside separate branches of the same insured lender is not separately covered. Depositors should know you to definitely federal rules expressly limits the degree of insurance the newest FDIC pays to depositors whenever an insured bank goes wrong, with no signal from any person or organization may either raise otherwise tailor you to count. Your Insured Deposits try a comprehensive dysfunction away from FDIC deposit insurance visibility for the most popular membership control groups.

The number of stockholders, lovers, otherwise professionals cannot impact the overall exposure. Such as, a people organization that have 50 participants will simply be eligible for $250,000 limit insurance policies, maybe not $250,one hundred thousand for every affiliate. The fresh FDIC was made during the peak of your own High Despair, following closure of 4,100 banking companies in the first several months away from 1933 and the loss of $1.3 billion within the deposits. President Franklin Roosevelt closed the fresh Banking Act away from 1933 for the June 16 of that 12 months, doing the brand new independent service. Consider the huge benefits and downsides out of Computer game profile to choose when the which discounts technique is good for you. Old-fashioned Dvds are the most typical form of Computer game, plus they secure a fixed APY for your identity.

It indicates you could contact the team at any time with inquiries you have. Our very own demanded casinos have really-educated agents that are educated on the video game, promotions, or any other characteristics given by this site. 100 percent free spin local casino incentives during the $1 casinos are simply just an informed to have professionals that have a would like to try out the newest incentives and features. Thankfully, totally free revolves is actually a popular introduction with $step one local casino bonuses as this makes you is actually the fresh online game free of charge and employ the new payouts to experience most other video game. Circling back to the point more than, learning the fresh offer’s info are of the utmost importance because it explains and therefore commission tips is actually acceptable to make use of.